Loans Schemes

Housing Loans

| Borrowers | All our existing customers / New customers properly introduced (only for firms and institutions). |

|---|---|

| Purpose |

|

| Loan Amount | Eligible loan amount will be calculated according to the project, subject to the repayment capacity of the borrower, based on his income/salary, subject to the maximum of Rs. 35.00 lacs. |

| Who are Eligible | Members of the Bank, Salary earners/businessman/enterprenuer/self-employed/ professional or engaged in any of valid gainful activity. |

| Security | Equitable mortgage of residential house/flat, for which loan availed and third party guarantee of one suitable person. |

| Repayment | In 60 EMIs (Maximum) |

| Rate of Interest | 14% p.a |

Personal Loan

| Borrowers | All salaried persons whose salary is credited at our bank branch or with ECS mandate. |

|---|---|

| Purpose | Purchase of consumer durable, personal consumption expenditure etc. |

| Loan Amount | Rs. 1.00 lakh (maximum) subject to repayment capacity of the borrower. |

| Who are Eligible | Members of the Bank, Salary earners/businessman/enterprenuer/self-employed/ professional or engaged in any of valid gainful activity. Either are Govt. employee or employee of Semi Govt. Dept./ Autonomous Bodies, Corporation, Board, where Govt. stake is involved or employee of certain approved educational/medical institutions. |

| Security | Salary Deduction Certificate, third party guarantee of one persons and check off facility. |

| Repayment | in 24 E.M.Is. (Equated monthly instalments) |

| Rate of Interest | 16% p.a |

Business Loan

| Borrowers | Small businessmen, Small Traders, Petty Vendors. |

|---|---|

| Purpose |

|

| Loan Amount | After retaining prescribed margin (20% on project involving capital expenditure & 25% on take-over Loans) remaining amount i.e. 75% to 80% of the project cost, (subject to repayment capacity of the borrowers and maximum ceiling of Rs. 35.00 lacs) will be financed. |

| Who are Eligible | Individuals/firms, engaged in gainful Business/ Service sector/Industrial activity in the area of operation of the Bank. |

| Security | For loan upto Rs. 1.00 lac only hypothecation of assets, purchased out of Bank Loan. For Loan above Rs. 1.00 lacs, collateral security by way of equitable mortgage of immovable property will be required. Third party guarantee of one person will also be obtained. |

| Repayment | In 60 EMIs (Maximum) |

| Rate of Interest | 14% p.a |

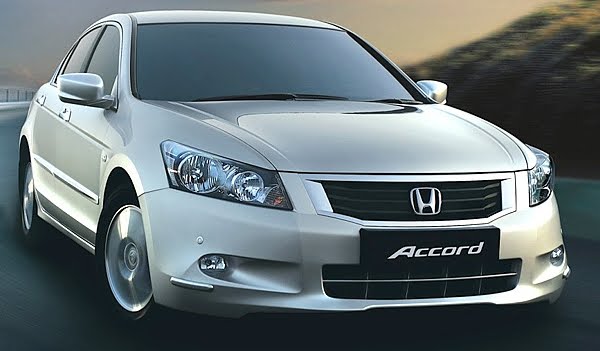

Vehicle Loan

| Borrowers | Salaried Person whose salary is credit at our bank branch or with ECS mandate or For business people who are Income tax assesses with previous 3 year I.T record. |

|---|---|

| Purpose |

|

| Loan Amount | 75% of cost of Brand new vehicle intended to be purchased, as per quotation, which should contain details, such as, name of standard make/Brand of the vehicle, company's name, Model and cost of vehicle etc. (subject to repayment capacity of the borrower and overall ceiling of Rs. 93.00 lacs). |

| Who are Eligible | All individuals, who are residing and employed in gainfull activity in the area of operation of the Bank and having valid driving licence are eligible for vehicle loan to purchase vehicle for the personal use. Persons/firms, having experience of carrying transport business and having valid drive licence to drive commercial transport vehicles, will be eligible for vehicle loan to purchase vehicle for commercial use. |

| Security | Hypothecation of vehicle (hypothecation clause in favour of Bank will have to be got included in the Registration Certificate of the vehicle purchased out of Bank finance). For loans above Rs.5.00 lacs, equitable mortgage of immovable property will also be required. Third party guarantee of one person (two persons, for loans upto Rs.5.00 lacs) will also be taken. |

| Repayment | Maximum in 60 EMIs. |

| Rate of Interest | __% p.a |

Mortgage Loan

| Borrowers | All our existing customers / New customers properly introduced. For both salaried and non-salaried. |

|---|---|

| Purpose |

|

| Loan Amount | 65% of the value of immovable property to be mortgaged, subject to repayment capacity of the borrower and overall ceiling of Rs. 5.00 lacs. |

| Who are Eligible | Individuals, who are residing and employed in valid gainful activity in the area of operation of the Bank. |

| Security | Equitable mortgage of immovable property and third party guarantee of one person. |

| Repayment | Maximum in 60 EMIs. |

| Rate of Interest | 16% p.a |

Gold Loan

| Borrowers | All our existing customers / New customers properly introduced. |

|---|---|

| Purpose |

|

| Loan Amount | Rs. 5,00,000 Maximum |

| Who are Eligible | Individuals, who are residing and employed in valid gainful activity in the area of operation of the Bank. |

| Security | Pledge of Gold ornaments duly appraised by the jewel appraiser regarding the purity of gold. |

| Repayment | Interest on Monthly Basis |

| Rate of Interest | 11.50% p.a |

Educational Loan

| Borrowers | All our existing customers / New customers properly introduced. |

|---|---|

| Purpose |

|

| Loan Amount |

|

| Who are Eligible | Indian Nationals within the area of operation of the Bank. |

| Security | Minimum 200% of the loan amount for the loans above Rs. 0.25 Lacs. |

| Repayment | Maximum in 120 EMI's |

| Rate of Interest | 14% p.a |

Loan against deposits (F.D./S.F.D. & R.D.) with the Bank

- Loan is allowed upto 75% of Deposits (FD/SFD & RD) to the depositors of the Bank.

- Interest 2% above the actual interest rate of deposit is charged.

- Loan is allowed promptly and without loss of any time.

Loan against N.S.C. / K.V.P.

- Persons, who are holding genuine NSCs/KVPs are allowed loan upto 75% of the value of NSCs/KVPs, after getting lien in Bank's favour marked from the concerned post office.

- Interest is recovered at the rate prescribed by the Bank from time to time (at present 14% P.A.)

Loan against L.I.C. Policy

- Persons having regular L.I.C. Policy since last 3 years (minimum) may be sanctioned loan upto 75% of the surrender value of that Policy to be ascertained from L.I.C. of India, and after getting the policy assigned in Bank's favour by L.I.C. of India.

- Interest will be recovered at the rate prescribed by Bank from time to time. (at present 14% P.A.)